Malt Beverage Market to Hit USD 19.03 Billion by 2035, Driven by Rising Demand for Alcohol-Free and Functional Beverages

Malt beverage market to reach $19.03 billion by 2035, driven by demand for flavored, low-alcohol, and craft products. Manufacturers can capitalize on key trends

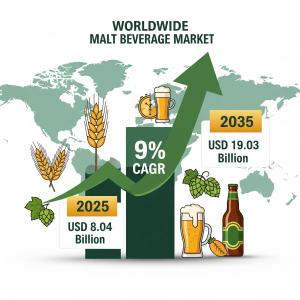

NEWARK, DE, UNITED STATES, August 18, 2025 /EINPresswire.com/ -- A new market analysis reveals the global malt beverage market is on a rapid growth trajectory, with its value projected to more than double from USD 8.04 billion in 2025 to USD 19.03 billion by 2035. This remarkable expansion, representing a compound annual growth rate (CAGR) of 9%, is fueled by a convergence of consumer trends, technological innovation, and a shift toward diverse and health-conscious options.

This surge presents a significant opportunity for manufacturers to address key challenges and tap into new revenue streams by aligning their strategies with evolving market demands.

Seizing the Flavor and Functionality Frontier

The report highlights that consumers are no longer satisfied with traditional offerings. The market is being reshaped by the rising demand for flavored malt beverages (FMBs) and hard seltzers, as well as an increasing interest in non-alcoholic alternatives. Brands that can deliver innovative flavors and formulations are poised for success.

A prime example is the recent launch of Blue Moon Extra by Molson Coors in April 2025. This 8% ABV product meets the consumer desire for higher alcohol content while maintaining a familiar flavor profile, a strategic move to diversify its portfolio. Similarly, Diageo's introduction of malt-based RTDs in the United States, with flavors like pineapple daiquiri and strawberry margarita, demonstrates the need for manufacturers to stay ahead of the curve in a fast-paced market.

Manufacturers can also capitalize on the growing demand for functional beverages. Energy drinks, which are projected to hold a 26.5% market share, are gaining momentum, particularly among younger consumers and athletes. Companies like Red Bull, Monster, and PepsiCo are already investing heavily in product innovation, focusing on natural ingredients and lower sugar content to meet this trend.

Navigating Regulatory Landscapes and Building Trust

For manufacturers, understanding and complying with regional regulations is critical for market access and consumer trust. The analysis emphasizes that adhering to a patchwork of government regulations—from the Alcohol and Tobacco Tax and Trade Bureau in the U.S. to the Food Safety and Standards Authority of India (FSSAI)—is mandatory.

Beyond basic compliance, certifications such as ISO 22000 and Good Manufacturing Practices (GMP) are becoming essential for building consumer confidence. For instance, producers in Australia and the European Union often obtain these certifications to signal their commitment to quality and safety.

Furthermore, with a growing consumer focus on sustainability, manufacturers who invest in eco-friendly practices and packaging will gain a competitive advantage. This commitment aligns with consumer values and is becoming a crucial competitive factor in a market increasingly influenced by environmental consciousness.

Regional Insights and Key Players

The report provides a nuanced view of regional market dynamics, revealing compelling growth stories for manufacturers.

• Italy, with its famous signature malt and booming craft beer scene, is set to lead with a robust 10.6% CAGR.

• The United Kingdom will see a 9.1% CAGR, driven by the popularity of malted health drinks and a vibrant pub culture.

• The United States market, expected to grow at an 8.7% CAGR, is characterized by a rapid pace of new product launches to satisfy consumer demand for variety.

The market is also characterized by a diverse competitive landscape. While Tier 1 companies like Anheuser-Busch InBev and Asahi Breweries dominate, generating 35% of the sector's revenue, there is significant room for others. Tier 3 companies, which include nimble brands like Fayrouz and Moussy, are projected to account for a substantial 54.6% of the revenue share. This indicates that innovation and local appeal can allow smaller players to thrive and capture significant market share.

The recent acquisition of Diageo’s share in Guinness Nigeria by Tolaram in June 2024, as well as Molson Coors' strategic product launches, shows the ongoing strategic movements in the market. This landscape of consolidation and innovation means manufacturers of all sizes must be agile to succeed.

Request Malt Beverage Market Draft Report - https://www.futuremarketinsights.com/reports/sample/rep-gb-4378

For more on their methodology and market coverage, visit https://www.futuremarketinsights.com/about-us.

A Future of Strategic Growth

The malt beverage market is entering a new era. The challenges of evolving consumer tastes, fragmented regulations, and the need for innovation are significant, but the growth potential is equally immense. The market's shift toward health-conscious, non-alcoholic, and unique flavor profiles offers a clear roadmap for manufacturers looking to expand their footprint.

By focusing on product innovation, strategic market entry, and a deep understanding of regional consumer behavior, manufacturers can effectively address their challenges and secure future growth in this dynamic and rewarding market.

Explore Related Insights

Malt Ingredients Market: https://www.futuremarketinsights.com/reports/malt-ingredients-market

Malt Market: https://www.futuremarketinsights.com/reports/malt-market

Malted Barley Flour Market: https://www.futuremarketinsights.com/reports/malted-barley-flour-market

Editors’ Note:

All data cited is from an independent market analysis report. This press release is intended for informational purposes and does not constitute financial advice.

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.