Smart Meter Data Management Market to Reach USD 7.0 Billion by 2035 | Fact.MR Report

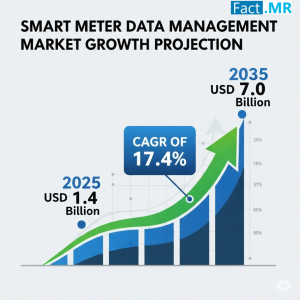

Smart Meter Management Market Is Forecasted To Total USD 1.4 Billion By 2025, Further Expected To Rise To USD 7.0 Billion By 2035, Advancing At A CAGR Of 17.4%

ROCKVILLE, MD, UNITED STATES, August 25, 2025 /EINPresswire.com/ -- Fact.MR today released its latest report on the Smart Meter Data Management Market, providing comprehensive insights into the global market’s robust growth driven by increasing smart meter deployments, rising data volumes, and the need for efficient energy management solutions. Valued at USD 1.4 billion in 2025, the market is projected to grow at a compound annual growth rate (CAGR) of 17.4%, reaching USD 7.0 billion by 2035. This significant expansion highlights the critical role of smart meter data management systems in optimizing utility operations and enhancing energy efficiency.For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=8380

Market Outlook and Growth Projections:

The global smart meter data management market is poised for substantial growth from 2025 to 2035, fueled by the widespread adoption of smart metering infrastructure and the need to manage vast amounts of data generated by these devices. Smart meter data management systems collect, store, and analyze data from smart meters, enabling utilities to improve billing accuracy, monitor energy consumption in real-time, and enhance grid reliability. The report projects the market to grow from USD 1.4 billion in 2025 to USD 7.0 billion by 2035, with a CAGR of 17.4%. This growth is driven by increasing investments in smart grid technologies, government mandates for smart meter rollouts, and the rising demand for data-driven energy solutions, creating significant opportunities for stakeholders.

Key Drivers Fueling Market Demand:

The market’s growth is propelled by several key drivers. The global deployment of smart meters, with over 1.2 billion units installed worldwide by 2023, generates massive data volumes, necessitating advanced management systems. For instance, the U.S. alone records nearly one million data points daily from 46 million installed smart meters, according to a 2019 Edison Foundation analysis. Government regulations and subsidies, such as the U.S. Department of Energy’s Smart Grid Investment Grant Program, are encouraging smart meter adoption, with countries like the UK reporting 21.4 million smart meters installed in 2020. The report highlights the growing need for real-time data analytics, accurate billing, and energy efficiency, alongside the integration of AI and IoT technologies, as key growth catalysts.

Challenges and Restraints in the Sector:

Despite its promising outlook, the market faces challenges. High implementation costs for smart meter data management systems, often exceeding USD 1 million for large-scale deployments, can deter smaller utilities. The report notes cybersecurity concerns, with smart meters vulnerable to data breaches, and a lack of standardized interoperability protocols, which complicates system integration. Additionally, limited awareness and infrastructure in developing regions, such as parts of Africa and Latin America, hinder adoption.

Segment-Wise Insights and Dominant Trends:

The report provides detailed segmentation analysis, identifying software as the leading component segment, holding a significant market share due to its role in processing, formatting, and analyzing meter data for accurate billing and analytics. On-premises deployment remains the preferred mode, accounting for the majority share in 2023, driven by utilities’ need for data control and security. Cloud-based solutions are the fastest-growing segment, with a projected CAGR of 18%, fueled by scalability and cost efficiency. By application, gas meters lead due to rising demand in the gas industry, while electricity meters are growing rapidly, driven by smart grid initiatives. Key trends include the integration of AI for predictive analytics, cloud-native platforms like Greenbird’s Utilihive for grid digitalization, and advanced metering infrastructure (AMI) for real-time data processing, enhancing operational efficiency.

Buy Report – Instant Access: https://www.factmr.com/checkout/8380

Regional Outlook and Growth Hotspots:

North America holds the largest market share, driven by the U.S. and Canada, which benefit from robust smart grid ecosystems and regulatory support, with the U.S. market valued at USD 91.4 million in 2024. Europe follows, with countries like the UK, Italy, and Sweden leading due to extensive smart meter rollouts, with Italy operating 30 million metering devices. The Asia-Pacific region is expected to exhibit the fastest growth, with a projected CAGR of 19%, fueled by rapid adoption in Japan, South Korea, and China, where smart grid investments are surging. Latin America and the Middle East and Africa (MEA) are emerging markets, supported by increasing digitalization and infrastructure upgrades.

Recent Developments:

The market has seen significant advancements in recent years. In 2024, Itron launched an upgraded version of its IEE Meter Data Management System, enhancing real-time analytics capabilities. Greenbird’s Utilihive platform, introduced in 2023, gained traction as a cloud-native API solution for grid digitalization. Posts on X highlight innovations like AI-driven anomaly detection in smart meter data, improving fraud prevention and grid reliability. Additionally, Siemens’ 2023 contract with ESB to deploy 25,000 smart meters in Ireland included advanced data management systems, boosting efficiency.

Key Players Insights:

Leading players are driving innovation through product development and strategic partnerships. Itron, Inc. leads with its comprehensive meter data management solutions, while Siemens AG and Schneider Electric SE excel in integrating AI and IoT technologies. Honeywell International Inc., ABB Group, Landis+Gyr, Kamstrup, and Sensus focus on scalable and secure platforms. Other key players, including Oracle Corporation and Greenbird, are investing in cloud-native and API-driven solutions. Recent moves include Itron’s 2024 partnership with a major U.S. utility to deploy AMI systems.

Competitive Landscape:

The market features a competitive ecosystem with key players driving innovation and market share. Companies profiled include Itron, Inc., Siemens AG, Schneider Electric SE, Honeywell International Inc., ABB Group, Landis+Gyr, Kamstrup, Sensus, Oracle Corporation, and Greenbird. These firms lead in developing advanced software and hardware for smart meter data management. The report includes a detailed competition dashboard, benchmarking, and market share analysis, highlighting strategies such as technological partnerships, product innovation, and expansion into emerging markets.

Check out More Related Studies Published by Fact.MR Research:

Air Traffic Smart Tower Solutions Market expects strong growth & stable CAGR by 2026. Rising demand for efficient logistics and travelling boosts growth.

Smart City Framework Market expects a strong growth by 2028. Rising demand for cutting operational cost and improvements in profitability boosts market growth.

S. N. Jha

Fact.MR

+1 628-251-1583

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.