Sucralfate Market Valued at USD 168.5 Million in 2025 Expected to Expand | Fact.MR Analysis

Analysis of Sucralfate Market Covering 30+ Countries Including Analysis of US, Canada, UK, Germany, France, Nordics, GCC countries

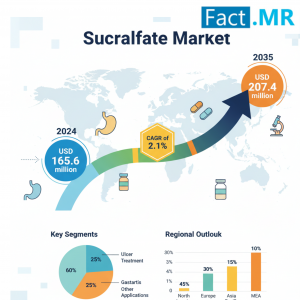

ROCKVILLE, MD, UNITED STATES, September 11, 2025 /EINPresswire.com/ -- The global Sucralfate Market demonstrates steady relevance as gastrointestinal disorders remain a common health concern worldwide. In 2024, the market was valued at USD 165.6 million, supported by increasing incidence of peptic ulcers, gastritis, gastroesophageal reflux disease (GERD), and the growing elderly population more vulnerable to digestive tract ailments. Sucralfate’s appeal lies in its ability to act locally on gastric mucosa with minimal systemic absorption, making it a preferred option for patients seeking treatment with fewer side effects. Generics and oral suspensions, especially for pediatric and geriatric use, contribute significantly to its uptake in both established and emerging healthcare markets.Sucralfate Market to Reach USD 207.4 Million by 2035:

Between 2025 and 2035, the sucralfate market is projected to grow to about USD 207.4 million. This growth reflects expanding access to gastrointestinal healthcare, improvements in drug delivery formulations, and greater awareness among both healthcare practitioners and patients. Though the market is not growing at an explosive rate, its steady increase underscores sucralfate’s enduring place among ulcer treatments.

The rise in generic formulations and availability in over-the-counter or suspension forms strengthens accessibility, while emerging economies in Asia-Pacific contribute a growing share to demand as healthcare infrastructure improves and diagnostic capabilities expand.

Sucralfate Market Growing at Approximately 2.1% CAGR (2025-2035):

During the forecast period, the market is expected to advance at a compound annual growth rate (CAGR) of around 2.1 percent. This modest but consistent growth rate acknowledges both restraint from competing therapies such as proton pump inhibitors (PPIs) and H2 receptor antagonists and opportunities presented by unmet medical need in certain populations. While PPIs often offer quicker symptom relief, sucralfate remains valuable in treatment regimens for patients who prefer treatments with fewer systemic effects or who require mucosal protection in ICU settings, stress ulcer prophylaxis, or complex ulcero-diaphragmatic conditions.

Segmentation and Regional Trends:

Sucralfate is marketed in several forms including powder, suspension, and granular or tablet formats. Powder form remains prominent as a bulk raw material for manufacturers and compounding pharmacies preparing suspensions for children or elderly patients. Oral suspension formats are important where ease of swallowing or palatability matters. Key applications include gastric or duodenal ulcer treatment, GERD management, stress ulcer prophylaxis in ICU scenarios, and oral mucositis. End-users primarily comprise hospitals, clinics, compounding pharmacies, and contract manufacturers who supply generics.

Geographically, North America leads the market due to well-established healthcare systems, greater awareness, and widespread use of generic versions. Europe follows with strong demand in Germany, France, and the UK, particularly among aging populations requiring alternates to acid suppression therapy. Asia-Pacific is seeing faster relative growth fueled by rising incidence of GI disorders, urbanization, lifestyle changes, and improving drug access. In Latin America and Middle East & Africa, growth is more gradual, constrained by regulatory delays and limited access, though improvements in healthcare infrastructure and generic drug penetration are gradually opening opportunities.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=10790

For more on their methodology and market coverage, visit: https://www.factmr.com/about-company

Drivers Behind Sucralfate Market Expansion:

A key driver is the ever-increasing burden of gastrointestinal disorders worldwide. Changes in diet, rise of stress, NSAID usage, alcohol consumption, and an aging demographic contribute to more frequent occurrences of ulcers, reflux, and gastritis. Sucralfate’s protective mechanism, forming a barrier over damaged mucosa, appeals in situations where systemic absorption is undesirable or when PPIs are contraindicated. Another driver is formulation innovation—oral suspensions have become more common to improve compliance among pediatric and geriatric patients. Generic competition has helped to reduce cost, while growing availability in emerging markets has increased patient access. Another force supporting the market is improved healthcare outreach and preventive care in many countries, as well as the rising emphasis on gut health and minimal side-effect treatments among both physicians and patients.

Recent Developments and Competitive Landscape:

In recent years, manufacturers have introduced new formulations designed to improve patient adherence, including oral suspensions and flavored or pediatric-friendly versions. Companies are also exploring improved muco-adhesive suspension formulas to enhance the protective action of sucralfate, especially in vulnerable populations or in outpatient care. Generic manufacturers in Asia have expanded production capacity, and in North America there have been approvals of generic equivalents for oral suspension forms, offering more treatment options. Regulatory attention has also focused more closely on formulation quality, labeling, and ease of use, especially for compounded products.

Key companies in the sucralfate market include Chemische Fabrik Kreussler & Co. GmbH of Germany, ALTANA AG, Alfa Chemical, Jiangsu Nhwa Pharmaceutical Co., Hubei Hongyuan Pharmaceutical, Yabang Pharma, Salius Pharma, Wuhan Senwayer Century Chemical, Hangzhou Hyper Chemicals, among others. These firms compete on the basis of product purity, formulation formats, cost competitiveness, regulatory compliance, and global distribution. Some smaller manufacturers specialize in suspension forms or in supplying raw sucralfate for compounding.

Challenges and Restraining Factors:

Despite sucralfate’s strengths, there are obstacles limiting its broader adoption. Alternatives such as PPIs and H2 receptor antagonists are often preferred because of their faster symptomatic relief. The necessity to administer sucralfate multiple times daily, sometimes on an empty stomach, reduces convenience. Regulatory frameworks in many emerging countries may impose delays on generic approvals or restrict OTC access, affecting affordability. Additionally, intellectual property on more innovative dosage forms or packaging can create barriers. Finally, awareness among general practitioners and patients about sucralfate’s niche roles and benefits is sometimes limited, affecting prescribing patterns.

Check out More Related Studies Published by Fact.MR:

U.S. Ductile Iron Pipes Market: https://www.factmr.com/report/us-ductile-iron-pipes-market

Lithium Chromate Market: https://www.factmr.com/report/lithium-chromate-market

Lithium Citrate Market: https://www.factmr.com/report/lithium-citrate-market

Editor’s Note:

This release is based exclusively on verified and factual market content derived from industry analysis by Fact.MR. No AI-generated statistics or speculative data have been introduced. This story is designed to support manufacturers, healthcare providers, and wellness brands in recognizing the Magnesium Phosphate Market as a major growth and innovation sector for the coming decade

S. N. Jha

Fact.MR

+1 628-251-1583

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.