Money Transfer Services Market In 2029

The Business Research Company's Money Transfer Services Market In 2029

LONDON, GREATER LONDON, UNITED KINGDOM, December 11, 2025 /EINPresswire.com/ -- "Money Transfer Services Market to Surpass $78 billion in 2029. In comparison, the Payments market, which is considered as its parent market, is expected to be approximately $1,131 billion by 2029, with Money Transfer Services to represent around 7% of the parent market. Within the broader Financial Services industry, which is expected to be $47,553 billion by 2029, the Money Transfer Services market is estimated to account for nearly 0.2% of the total market value.

Which Will Be the Biggest Region in the Money Transfer Services Market in 2029

Asia Pacific will be the largest region in the money transfer services market in 2029, valued at $29,150 million The market is expected to grow from $11,880 million in 2024 at a compound annual growth rate (CAGR) of 20%. The rapid growth can be attributed to the rising company partnerships and rising e-commerce.

Which Will Be The Largest Country In The Global Money Transfer Services Market In 2029?

India will be the largest country in the money transfer services market in 2029, valued $9,893 million. The market is expected to grow from $3,476 million in 2024 at a compound annual growth rate (CAGR) of 23%. The exponential growth can be attributed to the rising company partnerships and rising e-commerce.

Request a free sample of Money Transfer Services Market Report

https://www.thebusinessresearchcompany.com/sample_request?id=12606&type=smp

What will be Largest Segment in the Money Transfer Services Market in 2029?

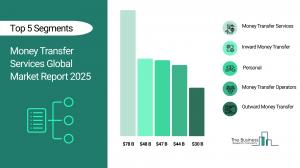

The money transfer services market is segmented by type into inward money transfer and outward money transfer. The inward money transfer market will be the largest segment of the money transfer services market segmented by type, accounting for 61% or $47,714 million of the total in 2029. The inward money transfer market will be supported by increasing remittance flows, supported by migration trends, favorable exchange rates and advancements in digital transfer platforms, supportive government policies and competitive exchange rates, which collectively enhance convenience and accessibility for recipients in developing economies.

The money transfer services market is segmented by channel into banks, money transfer operators and other channels. The money transfer operators market will be the largest segment of the money transfer services market segmented by channel, accounting for 57% or $44,168 million of the total in 2029. The money transfer operators market will be supported by increasing demand for efficient and secure cross-border and domestic payment solutions, advancements in digital and mobile technologies, competitive pricing models, the rising preference for real-time transaction processing to meet the needs of both individual and business users and rising disposable income.

The money transfer services market is segmented by end user into personal, small businesses and other end-users. The personal market will be the largest segment of the money transfer services market segmented by end user, accounting for 60% or $47,103 million of the total in 2029. The personal market will be supported by rising volume of remittances from migrant workers, increasing international travel, the growing adoption of mobile and digital money transfer platforms, the demand for faster, more secure transactions, competitive pricing, the convenience of instant transfers for personal needs such as family support, education and healthcare payments and rising global migration.

What is the expected CAGR for the Money Transfer Services Market leading up to 2029?

The expected CAGR for the money transfer services market leading up to 2029 is 17%

What Will Be The Growth Driving Factors In The Global Money Transfer Services Market In The Forecast Period?

The rapid growth of the global money transfer services market leading up to 2029 will be driven by the following key factors that are expected to reshape global financial connectivity and cross-border payment ecosystems.

Rising Smartphone Penetration- The increasing emphasis on smartphone penetration will become a key driver of growth in the money transfer services market by 2029. Smartphone-based money transfer services provide a cost-effective alternative to traditional remittance methods by offering lower transaction fees, particularly benefiting emerging markets. These services allow users to send funds internationally via their smartphones, eliminating the need for physical agencies and banks. This combination of convenience and reduced costs has been a key driver in the growth of global money transfer transactions.

Proliferation of Digital Payment Platforms- The growing focus on digital payment platforms will emerge as a major factor driving the expansion of the money transfer services market by 2029. Digital payment platforms offer seamless, 24/7 access to money transfers through mobile applications and online systems, eliminating the need for in-person visits to banking institutions. These platforms enable fast, near-instantaneous transactions, making them particularly suited for urgent remittances and payments.

Rising Urbanization-The expanding integration of urbanization processes will serve as a key growth catalyst for the money transfer services market by 2029, As urban areas expand, business activity and cross-border trade intensify, resulting in increased volumes of both domestic and international financial transactions. Money transfer services play a crucial role in enabling businesses to efficiently pay employees, suppliers and international clients, thereby fostering continued growth within the sector.

Access the detailed Money Transfer Services Market report here:

https://www.thebusinessresearchcompany.com/report/money-transfer-services-global-market-report

What Are The Key Growth Opportunities In The Money Transfer Services Market in 2029?

The most significant growth opportunities are anticipated in the inward money transfer services market, the personal money transfer services market and the money transfer operators and services (MTOS) market. Collectively, these segments are projected to contribute over $74 billion in market value by 2029, driven by rapid expansion of mobile-based remittances, increased adoption of digital and real-time payment platforms, and the modernization of cross-border transfer infrastructures. This surge reflects the accelerating shift toward low-cost, high-speed, and secure digital transfer solutions that enhance financial accessibility, improve compliance efficiency, and support growing migrant populations worldwide. As a result, the broader money transfer services industry is poised for transformative growth, fueled by rising financial inclusion initiatives, evolving regulatory frameworks, and continued innovation in digital payment ecosystems.

The inward money transfer services market is projected to grow by $25,215 million, the personal money transfer services market by $24,973 million and the money transfer operators and services (MTOS) market by $23,941 million over the next five years from 2024 to 2029.

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 17,500 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more.

Disclaimer: Please note that the findings, conclusions and recommendations that TBRC Business Research Pvt Ltd delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such TBRC Business Research Pvt Ltd can accept no liability whatever for actions taken based on any information that may subsequently prove to be incorrect. Analysis and findings included in TBRC reports and presentations are our estimates, opinions and are not intended as statements of fact or investment guidance.

Contact Us:

The Business Research Company

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company"

Oliver Guirdham

The Business Research Company

+44 7882 955267

info@tbrc.info

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.